The impact of market depth on trade with the star (XLM): Deep dive

The cryptocurrency markets have shown significant fluctuations in recent years, with many devices have significant price fluctuations. These volatile devices include Stern (XLM), a decentralized cryptocurrency that has been popular among institutional investors and merchants. In this article, we examine how market depth affects Stern XLM trade and how it affects market players.

What is the depth of the market?

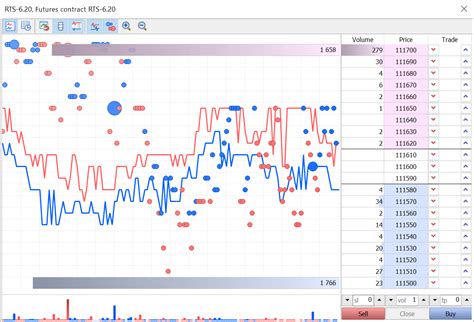

Market depth refers to purchase and sales orders that are available at a certain time in a set of tools. This represents the total amount of shops, which are carried out by merchants on a particular stock exchange or on a given platform. A deeper market means that there are several purchase and sales orders that may indicate a stronger demand for the device.

Stellar (XLM) Trade Quantity

The trading volume of Stern XLM has continued to grow in recent months, with high liquidity increasing significantly in periods. According to CoinMarketcap, XLM's 24-hour trade was recorded at a record $ 1.35 billion on February 22, 2022. This depth is in line with the growing popularity of assets as an investment tool.

Factors that influence the depth of the market

Many factors can affect the market depth of the cryptocurrencies:

- Size of order book : The number of purchasing and sales orders available in the order book affects the depth of the market.

- Market Capitalization : Assets with higher market capitalization generally have larger order books as they attract more merchants and investors.

- Commercial Volume : Increased commercial activity can lead to an increase in the depth of the market, while reduced activity can lead to lower market depth.

- Ordering process : The speed with which customers and sellers operate in commerce affects the liquidity of the financial value.

The effects on trade XLM

Market depth has a significant impact on the dynamics of Stern XLM trade:

- Increased risk of merchants : higher market depth can increase the risk of losses due to increased competition competition.

- Improved market efficiency : In the order book, several purchase and sales orders improve market liquidity and facilitate investors to implement business.

- Better price discovery : Market depth makes it easier to discover prices by measuring demand for XLM for merchants.

Follow the low market depth

Low market depth can have significant consequences for XLM trade:

- Decreased Liquidity : The size of the inadequate order book can result in a reduced liquidity, which makes business more difficult at affordable prices.

- Increased Volatility

: Low market depth can contribute to price fluctuations, as retailers can be transported with high risk due to limited purchase and sales orders.

Diploma

Market depth plays a decisive role in the dynamics of Stern XLM trade. As institutional investors and merchants alike are increasing in popularity, trading volume is expected to increase further. However, low market depth can cause increased risk for retailers and may result in reduced liquidity that may affect the general efficiency of the market.

Recommendations

In order to maximize profit in the long run, for merchants:

- Display your portfolio : Distribute investments to more assets to minimize your commitment to market fluctuations.

- Consider market news and trends : Stay up -to -date with regulatory developments, market feelings and economic indicators that may affect XLM's commercial activities.

- Use the Liquidity Authority Strategies : The size of the Faculty Book Using the Border Order or other mechanism to manage risk and use favorable market conditions.