Technical analysis techniques for cryptocurrency

In the world of cryptocurrency, there have been rapid growth and development in recent years, and a wide range of cryptocurrencies offers investors new opportunities for profit. However, navigating these complex markets can be frightening even for experienced merchants. In this article, we are studying technical analysis techniques that can help cryptocurrency investors make conscious decisions and increase their chances of success.

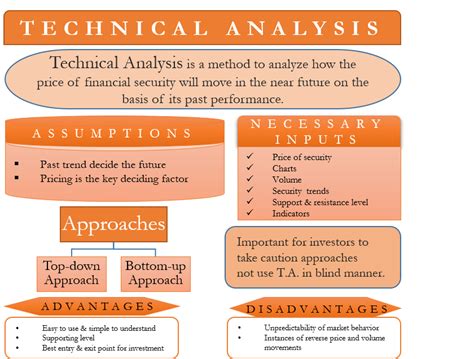

What is a technical analysis?

Technical analysis refers to research on charts, models and financial markets to predict future price changes. It includes the use of various tools and techniques to identify potential trading opportunities and make information -based investment decisions. In the context of cryptocurrency, the technical analysis takes into account the special features of each coin, such as its supply and demand levels, trading volumes and market opinions.

Key technical analysis indicators

Here are some key technical analysis indicators that can be used in the cryptocurrency market:

- Moving averages : These indicators describe the price level for a certain period of time, allowing merchants to identify trends and models.

- Relative Strength Index (RSI) : This indicator measures the magnitude of recent prices to determine excessive or oversized conditions.

- Bollinger lanes : These lanes represent the difference between the stock and its sliding average, indicating volatility.

4

- MACD (Sliding Average Conference Differences) : This indicator compares speed (fast) and trend (slow) to identify potential purchase or sales options.

Chart patterns

Understanding the diagram models is essential for technical analysis as they can help merchants predict future price changes. Here are some common chart model used in the cryptocurrency market:

- Head and Shoulders : The turning pattern that occurs when the safety price reaches the top of the area and then turn the direction.

- Triangles : A formation in which prices form two opposite trends and then often turn the sequel or repair trend.

- Waves : A series of consecutive lower heights and larger lower, indicating potential support or resistance levels.

News and Events

The cryptocurrency market is strongly influenced by news and events that may affect prices. Here are some key factors that need to be taken into account:

- Changes in Regulatory : Government regulations can have a significant impact on the implementation and use of cryptocurrency.

- Economic indicators : GDP growth rates, inflation and employment figures can affect market opinions.

- Market : Social media news and updates can create positive or negative bias in the market.

Tools for cryptocurrency trade

To use technical analysis techniques, merchants need access to reliable tools and platforms. Here are some popular options:

- Trading environments : websites such as Coinbase Pro, Binance and Kraken offer advanced trading opportunities.

- Mapping software

: Tools such as Metatrader 4 (MT4) and MT5 offer a selection of technical analysis indicators and charts.

- Information providers : Applications and feeding of information about exchange, such as CoinmarketCap, Coingecko and Coindesk, provide real -time market information.

The best practices of the cryptocurrency trade

To succeed in the cryptocurrency trade, merchants should follow these best practices:

- Your versatile portfolio : Apply investment between different cryptocurrencies to minimize risks.

- Set clear goals : Define your investment objectives and risks tolerance before entering the market.

3.